A Property Tax Could Best Be Described as

Learn faster with spaced repetition. Sales taxes gross receipts taxes value-added taxes and excise taxes.

Property Tax How To Calculate Local Considerations

For example vacant land will have a significantly lower assessed value than a.

. Different property types have various types of tax assessed on the land and its structures. Add your answer and earn points. A tax you get when you owe property.

The companys cash taxes paid divided by net income from continuing operations. As a power taxation is a way of apportioning the cost of government among those who are privileged to enjoy its benefits. 1 Property taxes are an example of a cost that would be considered to be.

Discover the three basic tax typestaxes on what you earn taxes on what you buy and taxes on what you own. A companys effective tax rate can best be described as. Learn about 12 specific taxes four within each main categoryearn.

Individual income taxes corporate income taxes payroll taxes and capital gains taxes. The legal description pinpoints the location of a given property within its particular township range and section. Selection of the object or subject of tax b.

Fixing the tax rate to be imposed is best described as a an. A property tax could best be described as a 1 See answer Advertisement Advertisement blah4849 is waiting for your help. 2 Parts administration is an example of a.

Property tax is an ad valorem tax assessed on real estate by a local government and paid by the property owner. Social Studies 22062019 1000 faithcalhoun. The tax assessment is based on the best.

This is the best answer based on feedback and ratings. The companys cash taxes paid divided by taxable income. The tax base may be the land only the land and buildings or various permutations of these factors.

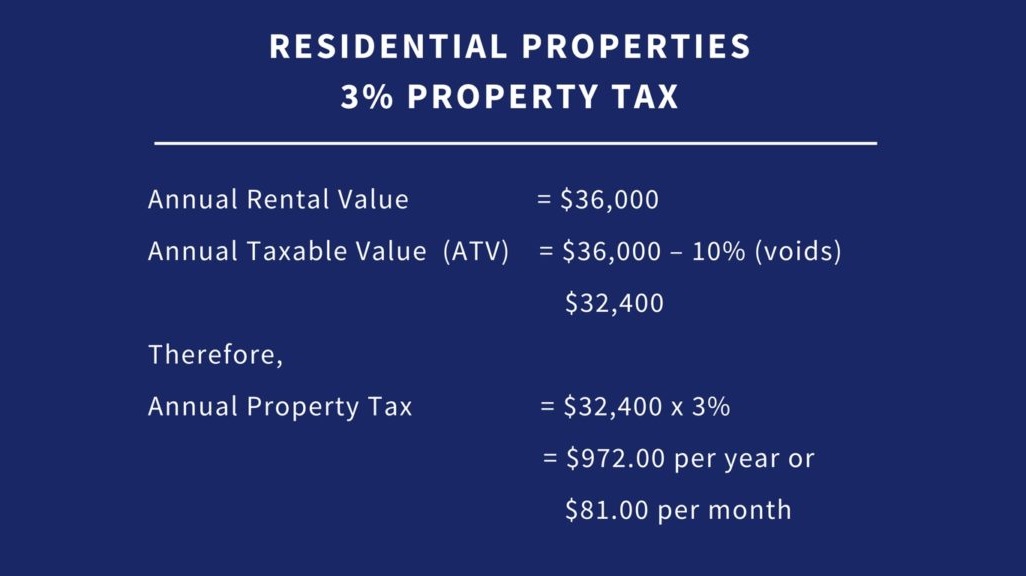

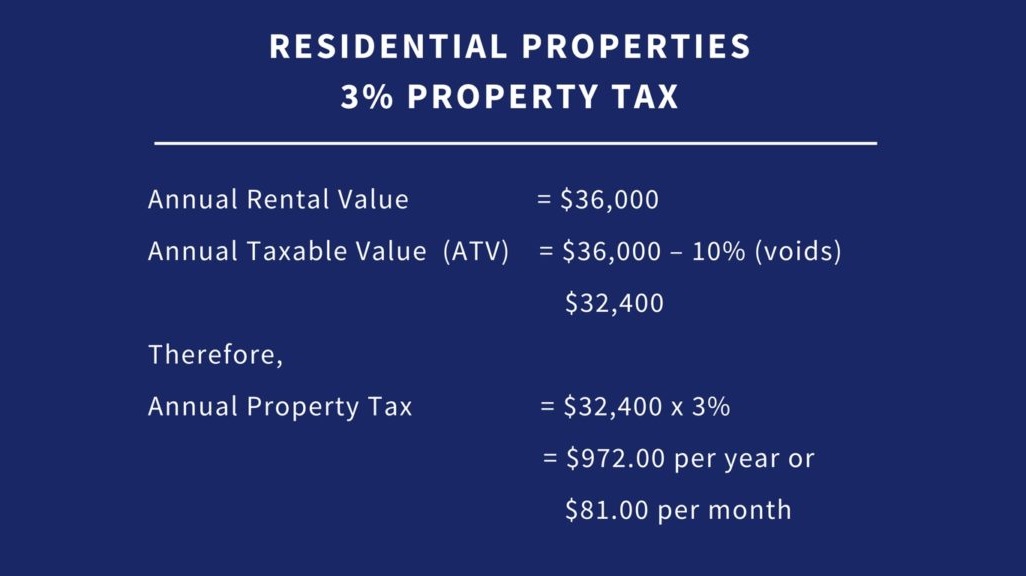

Property taxes are a type of ad valorem taxthe term is Latin for according to valueso it follows that theyre calculated based on an assessment of your propertys value. Organization-sustaining activities are carried out regardless of which customers are served which products are produced how many batches are run or how many units are made. This tax may be imposed on real estate or personal propertyThe tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate and is generally an obligation of the owner of the property.

Study Chapter 8 - Real Estate Taxes and Liens flashcards from Anthony Smiths class online or in Brainscapes iPhone or Android app. Townships run north and south and range lines run east and west. Property taxes are based on your propertys value multiplied by a tax or mill rate set by the local government or taxing authority.

A property tax or millage tax is levied on the value of property an ad valorem tax that the owner is required to pay. Local property taxes fund schools fire departments and libraries and they can be a major source of funding for your city or county. 3 Get Other questions on the subject.

It is a direct tax. Prior to 2018 there is not a cap for these deductions although large amounts of these deductions can cause you to be subject to the Alternative Minimum Tax and therefore offset a large deduction. A property tax could BEST be described as a.

Beginning in 2018 deductions for state and local taxes including personal property taxes are capped at 10000 per tax return. 31 Property tax is an annual tax on real property. All of the following are legislative aspect of taxation except.

It is usually but not always a local tax. Property taxes are an example of a cost that would be considered to be. As a citizen of a country you must pay tax and property tax is one of them when you owe property you must pay.

Which conflict is often referred to as the first televised war. Property taxes are an example of a cost that would be considered to be. Function that could be exercised by the executive branch.

Log in for more information. Property tax is a local government ad valorem tax -- a tax on the assessed value of real estate owned most often a house and the land where it sits paid to a local government by the owner. Taxation could be described as power as a process or as a means.

For the purposes of this guide property tax is restricted to annual taxes and excludes one-off taxes on transfers on realised. The companys financial statement income tax provision divided by taxable income. While property taxes are deductible the Tax and Job Cuts Act of 2018 put a cap of 10000 on deductions that were listed as federal and local taxes.

Taxes may be used as a tool and weapon in international relations and to protect trade relations. Aspect of taxation which could be delegated. Assessing Property Tax.

Most local governments in the United States impose a property tax also known as a millage rate as a principal source of revenue. 3 Which of the following would probably be the most. It is most commonly founded on the concept of market value.

For example each township is six square miles or 23040 acres and contains 36 square sections which are each intended to be one square mile or 640 acres.

Deducting Property Taxes H R Block

Not Really Funny At All Income Tax Property Tax Capital Gains Tax

Not Really Funny At All Income Tax Property Tax Capital Gains Tax

What Landlords Need To Know About Schedule E Form Landlord Studio Tax Deductions Property Tax Being A Landlord

Your Property Tax Assessment What Does It Mean

3 Reasons Why You Need A Financial Planner The Money Tree Market In 2021 Property Management Financial Planner Management

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Florida Property Tax H R Block

Example Rental Deposit Form Acceptance Letter Business Template Deposit

How Property Taxes Are Calculated

Winnipeg Property Tax 2021 Calculator Rates Wowa Ca

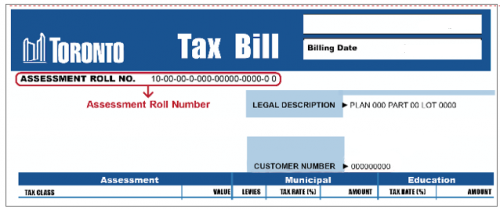

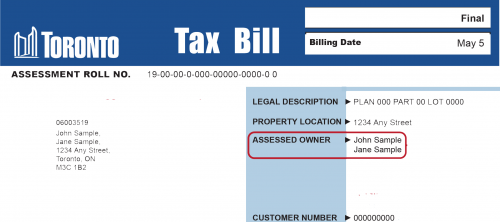

Making Online Payments City Of Toronto

Buying Selling Or Moving City Of Toronto

How Much Does Holding A Property Really Cost Check Out The 6 Holding Costs That Add Up The Most Hold On Selling Your House Spending Money

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

Alberta Property Tax Rates Calculator Wowa Ca

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Property Tax Assessment

Comments

Post a Comment